Text messaging has become one of the fastest, most convenient ways to communicate—and unfortunately, it has also become a favorite tool for scammers.

The Federal Trade Commission (FTC) reported that in 2023, consumers suffered over $437 million in losses due to SMS/text scams, an increase from $330 million in 2022. The median loss per victim was around $1,100, indicating a steady rise each year. Scams involving banks and financial institutions continue to be among the most prevalent types of text scams, with thousands of incidents reported annually.

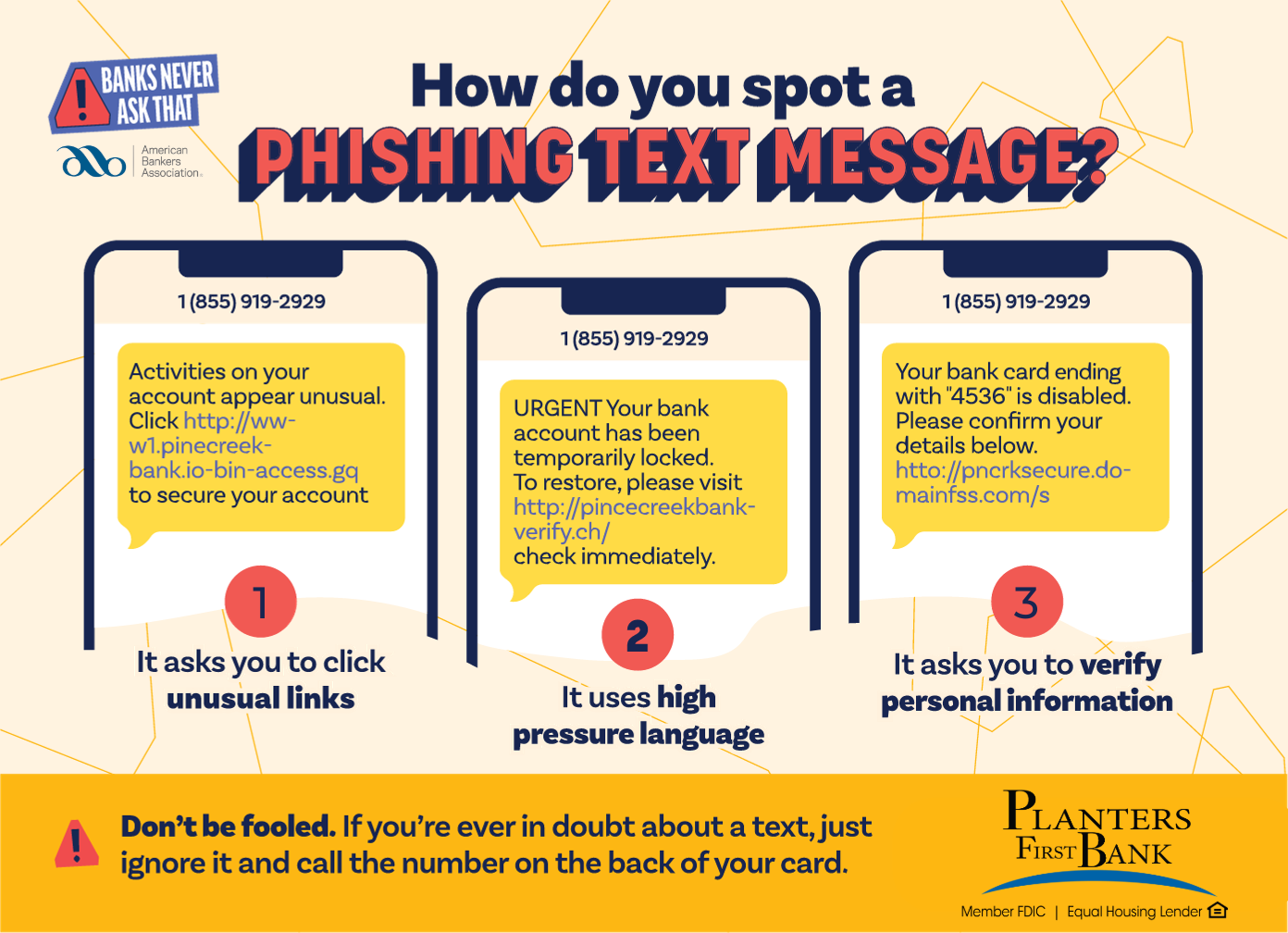

How to Spot a Bank Text Scam

Criminals know that text messages are a quick, inexpensive, and effective way to trick people into giving up personal information. That’s why it’s so important for consumers to recognize these scams and know how to protect themselves. Scam texts often mimic real bank alerts, creating a sense of urgency to get you to act quickly. They may claim:

- An unauthorized transaction has occurred

- You need to verify a charge at a specific retailer

- Your account is at risk

Some scam messages are easy to spot because of poor grammar or spelling errors, but others look very convincing. Familiarizing yourself with how your bank communicates via text can help you distinguish between a real message and a scam.

How Banks Use Text Messaging

Many banks, including Planters First Bank, use text messages to:

- Provide account alerts such as balance notifications, payment reminders, or suspicious activity

- Notify you of potential fraud

Each bank has its own processes, so it’s important to know what types of messages your bank sends and the short codes or numbers they use.

How Bank Text Scams Work

Scammers often trick you into clicking a link or replying to confirm a charge. Doing so can:

- Lead to fake forms asking for personal or account information

- Install malware on your device

- Allow scammers to gather more information to commit financial fraud

Responding “yes” or “no” can alert scammers that your number is active, which could lead to phone calls requesting additional details like your email, account numbers, or login credentials.

Signs a Bank Text is Legitimate

- The bank will never ask for confidential information via text

- Texts will come from official short codes assigned to the bank

- Avoid responding to messages that provide unfamiliar phone numbers or email addresses

- Look for typos, grammatical errors, or unprofessional formatting—these are red flags

- Only click links that lead to the official bank website

What to Do if You Receive a Scam Text

If you get a suspicious text:

- Delete it immediately

- Do not click any links or reply

- Contact Planters First Bank directly using the official phone number, email, or online chat

- Report the scam to the bank to help prevent further fraud

If you believe your personal information has been compromised, immediately change your passwords, PINs, and account login details. By understanding how these scams work and knowing what to look for, you can avoid falling victim and keep your finances safe. If you have questions or want to report a suspicious message, contact Planters First Bank at (833) 732-8351.